In crypto, it’s rare to find a Layer 1 that ticks all the boxes:

✅ Record-breaking performance

✅ High-profile backing

✅ Real-world use cases with banks

✅ Built-in regulatory compliance

Keeta Network doesn’t just aim to be the most scalable network in the world ⟶ it’s already advancing partnerships with banks, Visa, Google Cloud and potentially major fintech players.

Its target market: Multiple trillions of dollars in global payments.

📌 Quick Summary

Type: High-performance L1 with smart contracts.

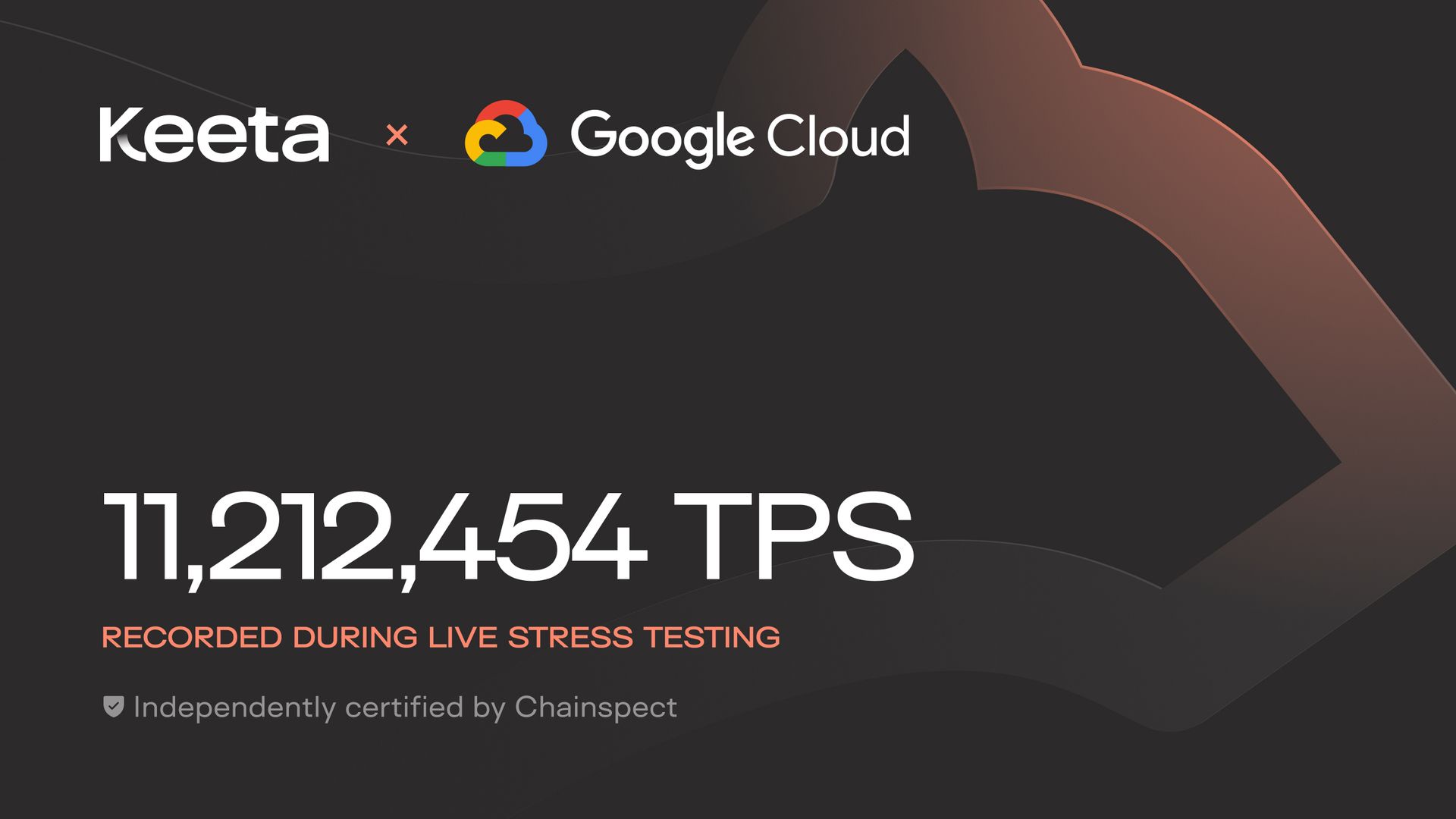

Performance: 10–11M TPS, 400 ms finality (world record validated by Chainspect with Google’s support).

Focus: Regulated global payments and settlements.

Backing: Eric Schmidt (ex-CEO of Google, only previously supported Chainlink).

Early Adoption: Bank of America, Visa, +50 banks in 50 regions.

Compatibility: ISO 20022, KYC/AML, connection with SWIFT and traditional payments.

Market Cap: $600M (outside top 150).

Risk: High — low cap but with real traction and big potential.

Catalysts: Featured in Nilson Report, Visa Global Registry, Google Cloud blog.

1. The Vision

Keeta positions itself as the network of networks:

Full interoperability: connects blockchains, banks, payment systems, and FX on-chain.

Native compliance: KYC, AML, and digital identity integrated at the protocol level.

Real-time payments: no third parties or extra layers.

Advanced asset rules: issuers can restrict transfers to regulator-approved wallets.

🎯 Goal: replace and improve the global financial infrastructure.

(SWIFT alone processes $7T/day).

2. Top-Tier Backing

Eric Schmidt (ex-CEO of Google):

Lead investor.

Says this could be the biggest project he’s ever been involved in.

Direct relationship with the team and public support.

Key institutional validation:

Featured in The Nilson Report — the most influential payment industry publication.

Read by Visa, Mastercard, major banks, and fintech executives.

Subscription costs $2,395/year, with no ads or sponsored content.

Clear sign Keeta is already on the radar of top decision-makers.

Keeta is officially listed on Visa’s Global Registry of Service Providers — another strong signal of institutional validation.

Google Cloud just published an official blog breaking down how Keeta achieved 11M TPS using Spanner: giving the project public visibility to enterprises and financial institutions.

Read it here →

“Tens of trillions of dollars worth of value are transferred across outdated financial systems daily — and Keeta Network has proven it has the speed, scale, and security to be the foundation for a new, interconnected ecosystem.”

3. Unique Technology

User-specific DAGs: millions of parallel DAGs, eliminating bottlenecks.

True horizontal scaling with multi-machine validators.

Native tokenization without smart contracts.

Configurable privacy for approved nodes.

Anchors to tokenize real-world or crypto assets.

Private bank sub-chains with their own governance.

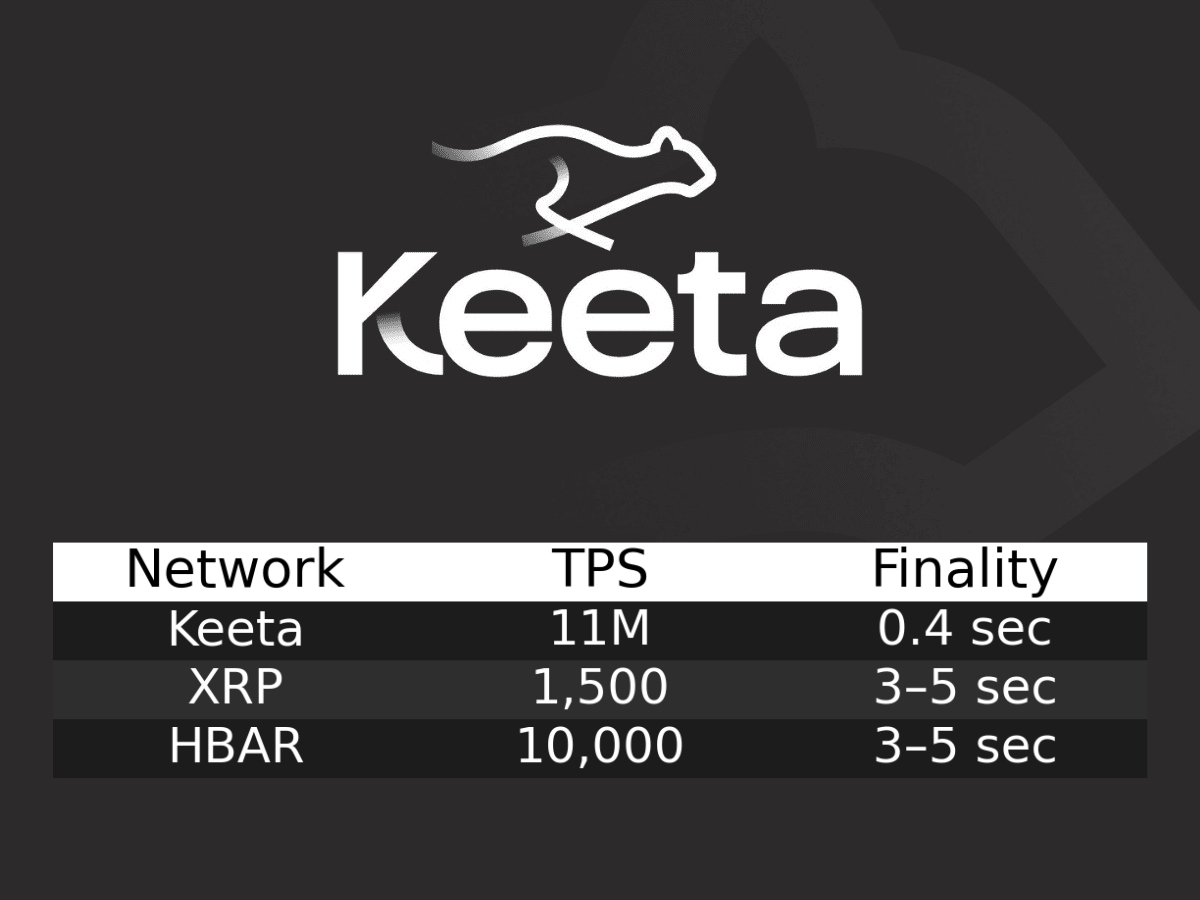

📊 Performance & Finality Comparison:

Keeta: 11,000,000 TPS — 0.4 s finality

XRP: 1,500 TPS — 3–5 s finality

HBAR: 10,000 TPS — 3–5 s finality

Sui / Aptos: 180k–300k TPS

The performance gap is massive: Keeta is not only faster, but finalizes transactions almost instantly.

Keeta Stats

4. Key Features for Institutional Adoption

Optional KYC accounts.

On-chain FX with automatic asset conversion.

Asset rules by jurisdiction.

Native DEX for crypto and tokenized commodities.

PASS (On-chain Credit Bureau) with SOLOAPI: identity, income, and crypto holdings in a verified profile.

5. Traction & Real-World Use

+50 banks in 50 regions using private versions as central ledgers.

Bank of America: internal settlement pilot.

Visa: card trials and instant cross-border payment tests.

Kraken listing ⟶ immediate liquidity access and added institutional credibility.

KaPay: Venmo-style app for global crypto payments.

6. Narrative & Positioning

Institutional narrative similar to XRP ⟶ but with much more advanced technology and live pilots.

Built on Base (Coinbase’s L2) → potential direct integration into Coinbase.

7. Roadmap & Catalysts

✅ Completed catalysts

Featured in The Nilson Report (payments industry bible).

Keeta listed on Visa’s Global Registry of Service Providers.

Google Cloud published an official blog detailing Keeta’s 11M TPS performance with Spanner.

Public stress test (10M+ TPS) already validated.

Mainnet launch in June 2025 with multiple partnerships.

🚀 Upcoming catalysts

Stablecoin partner announcement after mainnet.

Visa card and KaPay launch.

Founder Tai Shank speaking at Salt Wyoming (Aug 20) to regulators and financial leaders.

More unannounced surprises.

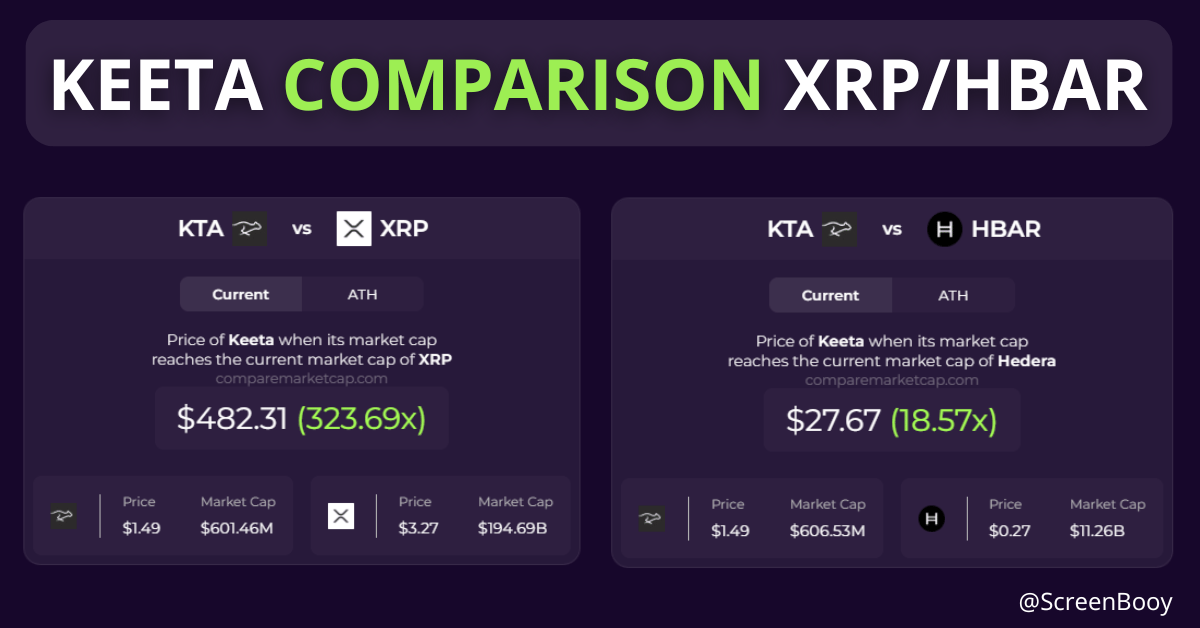

8. Potential vs Competitors

💰 Current market caps:

XRP: $195B

HBAR: $11.2B

Keeta: $0.6B

📈 Theoretical upside:

Match XRP → x323

Match HBAR → x18

Perspective: While XRP and HBAR reached multi-billion valuations without clear regulatory alignment, Keeta is entering the market with built-in compliance and live pilots with banks ⟶ yet it’s valued under $1B.

9. Risks

⚠ Young project, not yet tested at large public scale.

⚠ Reliance on key partners.

⚠ High volatility.

⚠ Strong competition: XRP, HBAR, and future regulated L1s.

✅ However, Keeta has addressed one of the biggest concerns for new L1s: Token unlocks.

40% of $KTA supply (Team + Early investors) is assigned as equity to Keeta Inc. ⟶ Making them UNSELLABLE on the open market.

This ensures 0% sell pressure from these allocations, setting a precedent in tokenomics.

This effectively eliminates future sell pressure from insiders, giving Keeta one of the cleanest tokenomics structures in the industry.

🔍 Conclusion

Keeta Network aims to solve a massive, real-world problem: global payment infrastructure.

It offers unique tech, top-tier backing, solid institutional validation, and live pilots with banks and Visa.

Its valuation is far below competitors with less clear use cases, but it’s still a high-risk play due to its low cap.

💡 If you enter, do so with capital you’re willing to lose ⟶ and follow the project closely.

Investment Thesis: Keeta is positioning itself as the compliance-first backbone for trillions in payments. If execution matches the vision, it could redefine the intersection of crypto and traditional finance.

Found this project interesting? → Let me know your thoughts on X: @Screenbooy

If you enjoyed this breakdown, share it with a friend in crypto!

Not subscribed yet? Join Screenbooy Alpha for weekly airdrop insights, opportunities and deep dives.

A big hug!

Enjoy the summer.

— Screenbooy Alpha